How to Calculate 2023 Taxes: A Step-by-Step Guide

Calculating taxes can be a daunting task for many people. With the ever-changing tax laws and regulations, it can be difficult to keep up with the latest changes. As the year 2023 approaches, it is important to start thinking about how to calculate your taxes for the upcoming year. By understanding the basics of tax calculations, you can ensure that you are prepared when tax season arrives.

The first step in calculating your taxes is to determine your taxable income. This includes all income that you have earned throughout the year, including wages, salaries, tips, and investment income. Once you have determined your taxable income, you can then deduct any eligible expenses and deductions, such as charitable donations, mortgage interest, and student loan interest. This will give you your adjusted gross income (AGI), which is used to determine your tax liability.

After you have determined your AGI, you can then calculate your tax liability using the appropriate tax rates and brackets. The tax rates and brackets are based on your filing status, such as single, married filing jointly, or head of household. It is important to note that the tax rates and brackets can change from year to year, so it is important to stay up-to-date on the latest tax laws and regulations. By following these basic steps, you can ensure that you are prepared to calculate your taxes for the year 2023.

Understanding Tax Basics

Tax Year Overview

The tax year is the 12-month period for which taxpayers file their annual income tax returns. For most individuals, the tax year runs from January 1 to December 31. However, in some cases, the tax year may differ based on the type of taxpayer or business entity. It is important to understand the tax year in order to accurately calculate and file taxes.

Federal Income Tax Rates

Federal income tax rates are determined by the taxpayer’s taxable income, which is the amount of income that is subject to tax after deductions and exemptions. The tax rates are progressive, meaning that the higher the income, the higher the tax rate. The IRS adjusts the tax rates each year to account for inflation. For tax year 2023, the tax rates range from 10% to 37%. The IRS also provides tax brackets that indicate the income range for each tax rate.

Standard Deduction vs. Itemized Deductions

Taxpayers can choose to take either the standard deduction or itemized deductions when filing their tax returns. The standard deduction is a fixed amount that is subtracted from the taxpayer’s taxable income. For tax year 2023, the standard deduction for a single taxpayer is $12,100. Itemized deductions, on the other hand, are specific expenses that can be deducted from the taxpayer’s taxable income. Examples of itemized deductions include mortgage interest, state and local taxes, and charitable contributions. Taxpayers should choose the deduction method that results in the greatest tax savings.

Understanding these tax basics is essential for accurately calculating and filing taxes. Taxpayers should consult with a tax professional or use online tax calculators to ensure that they are taking advantage of all available deductions and credits.

Determining Your Filing Status

When calculating taxes, the first step is to determine your filing status. The filing status you choose will affect your tax rate, deductions, and credits. There are three main filing statuses: Single or Joint Filing, Head of Household, and Qualifying Widow(er) with Dependent Child.

Single or Joint Filing

If you are unmarried or legally separated from your spouse, you can file as a single taxpayer. If you are married, you can choose to file jointly with your spouse. Filing jointly can often result in a lower tax bill, as the tax brackets for married couples are wider than those for single filers. However, it is important to note that both spouses are jointly liable for any taxes owed.

Head of Household

If you are unmarried and provide more than half of the financial support for a qualifying dependent, you may be eligible to file as head of household. This filing status offers a higher standard deduction and lower tax rates than filing as a single taxpayer. To qualify, you must have paid more than half the cost of keeping up a home for a qualifying person for more than half the year.

Qualifying Widow(er) with Dependent Child

If your spouse died within the last two years and you have a dependent child, you may be eligible to file as a qualifying widow(er) with dependent child. This filing status offers the same tax rates and brackets as married filing jointly. To qualify, you must have a dependent child and have paid more than half the cost of keeping up a home for yourself and your dependent for the tax year.

Determining your filing status is an important first step in calculating your taxes. By understanding the requirements for each filing status, you can choose the one that will result in the lowest tax bill and maximize your deductions and credits.

Calculating Taxable Income

To calculate 2023 taxes, one must first determine their taxable income. Taxable income is calculated by subtracting any adjustments, deductions, and exemptions from gross income.

Gross Income Calculation

Gross income is the total income received from all sources before any deductions or adjustments. This includes wages, salaries, tips, interest, dividends, and any other income received during the year.

To calculate gross income, add up all sources of income for the year. This can be found on a W-2 form for employees or on a 1099 form for self-employed individuals.

Adjustments to Income

Adjustments to income, also known as above-the-line deductions, are deductions that can be taken regardless of whether the taxpayer itemizes deductions or takes the standard deduction.

Some common adjustments to income include contributions to a traditional IRA, student loan interest, and self-employment taxes.

To calculate adjustments to income, subtract the total amount of these deductions from gross income. The result is known as adjusted gross income (AGI).

Exemptions and Deductions

After calculating AGI, taxpayers can then subtract any exemptions and deductions to arrive at their taxable income.

Exemptions are a set dollar amount that taxpayers can deduct from their income for themselves and their dependents. Deductions are expenses that can be subtracted from income, such as mortgage interest, charitable donations, and state and local taxes.

Taxpayers can choose to take either the standard deduction or itemize their deductions. The standard deduction is a set dollar amount that varies based on filing status. Itemized deductions are the total of all eligible deductions, including mortgage interest, charitable donations, and state and local taxes.

By subtracting exemptions and deductions from AGI, taxpayers can arrive at their taxable income. This is the amount of income that is subject to federal income tax.

Overall, calculating taxable income involves adding up all sources of income, subtracting adjustments to income, and then subtracting exemptions and deductions. By following these steps, taxpayers can accurately calculate their taxable income for the 2023 tax year.

Applying Tax Credits

Common Tax Credits

Tax credits can be a great way to reduce your tax liability and potentially increase your tax refund. Some common tax credits for the 2023 tax year include:

- Child Tax Credit: This credit is available for parents or guardians of dependent children under the age of 17. The maximum credit amount is $3,000 per child and is partially refundable.

- Earned Income Tax Credit (EITC): This credit is available for low to moderate-income taxpayers who have earned income. The credit amount varies based on income and family size.

- American Opportunity Tax Credit (AOTC): This credit is available for taxpayers who are paying for higher education expenses. The maximum credit amount is $2,500 per eligible student.

- Lifetime Learning Credit (LLC): This credit is available for taxpayers who are paying for higher education expenses. The maximum credit amount is $2,000 per tax return.

Calculating Credit Amounts

To calculate the amount of tax credit you can claim, you will need to gather information about your income, expenses, and eligibility requirements. The specific calculation method will depend on the type of tax credit you are claiming.

For example, to calculate the Child Tax Credit, you will need to know the number of eligible children you have, your income, and whether you meet certain eligibility requirements. The credit amount is then calculated based on a percentage of your eligible expenses, up to a maximum amount.

To calculate the EITC, you will need to know your earned income, adjusted gross income, and the number of eligible children you have. The credit amount is then calculated based on a percentage of your earned income, up to a maximum amount.

It’s important to note that some tax credits are refundable, which means that if the credit amount is greater than your tax liability, you may be eligible for a refund. Other tax credits are non-refundable, which means that they can only reduce your tax liability to zero.

Overall, tax credits can be a valuable tool for reducing your tax liability and potentially increasing your tax refund. By understanding the eligibility requirements and calculation methods for common tax credits, you can maximize your tax savings and keep more of your hard-earned money.

Special Tax Situations

Self-Employment Tax

If you are self-employed, you will need to pay self-employment tax, which is a combination of Social Security and Medicare taxes. The self-employment tax rate for 2023 is 15.3% of your net earnings from self-employment. However, you can deduct one-half of your self-employment tax as an adjustment to income on your tax return.

To calculate your self-employment tax, you will need to use Schedule SE (Form 1040). You can use the IRS tax withholding estimator tool to estimate your self-employment tax liability for 2023.

Capital Gains Tax

If you sold any assets such as stocks, bonds, or real estate in 2023, you may owe capital gains tax. Capital gains tax is a tax on the profit you made from selling an asset. The amount of tax you owe depends on your income level and how long you held the asset before selling it.

Short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate, while long-term capital gains (assets held for more than one year) are taxed at a lower rate. You can use the IRS tax withholding estimator tool to estimate your capital gains tax liability for 2023.

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) is a separate tax system that was designed to ensure that high-income taxpayers pay a minimum amount of tax. If your income is above a certain threshold, you may be subject to the AMT.

To calculate your AMT liability, you will need to use Form 6251. The AMT exemption amount for 2023 is $74,900 for single taxpayers and $114,000 for married taxpayers filing jointly. If your AMT liability is more than your regular tax liability, you will need to pay the higher amount. You can use the IRS tax withholding estimator tool to estimate your AMT liability for 2023.

It is important to note that these are just a few of the special tax situations that taxpayers may encounter. If you have a more complex tax situation, it may be beneficial to seek the advice of a tax professional.

Filing Your Taxes

Filing taxes can be a daunting task for many people, but it doesn’t have to be. By following a few simple steps, you can ensure that your taxes are filed accurately and on time.

Choosing a Filing Method

Taxpayers have two options when it comes to filing their taxes: electronic or paper. Electronic filing is becoming increasingly popular due to its convenience and speed. Taxpayers can use tax preparation software to file their taxes online or they can hire a tax professional to file their taxes electronically. Alternatively, taxpayers can choose to file their taxes by mail using paper forms.

Electronic vs. Paper Filing

Electronic filing has several advantages over paper filing. First, it is faster and more convenient. Taxpayers who file electronically can receive their refunds in as little as 21 days, while those who file by mail may have to wait up to six weeks. Second, electronic filing is more accurate. The software used to file taxes electronically checks for errors and omissions, reducing the likelihood of mistakes. Third, electronic filing is more secure. Taxpayers who file electronically can receive confirmation that their return has been received and accepted by the IRS.

Deadlines and Extensions

Taxpayers must file their federal income tax returns by April 15th of each year. However, if April 15th falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers who are unable to file their taxes by the deadline can request an extension by filing Form 4868. This will give them an additional six months to file their taxes, but they must still pay any taxes owed by the original deadline to avoid penalties and interest.

In summary, taxpayers have the option to file their taxes electronically or by mail. Electronic filing is faster, more accurate, and more secure. Taxpayers must file their taxes by April 15th each year, but can request an extension if needed. By following these guidelines, taxpayers can ensure that their taxes are filed accurately and on time.

After Filing Your Taxes

Once you have filed your tax return, it is important to understand what happens next. In this section, we will discuss three important topics that you should be aware of: Understanding Your Notice of Assessment, Handling Audits, and Amending Your Tax Return.

Understanding Your Notice of Assessment

After you file your tax return, you will receive a Notice of Assessment from the Canada Revenue Agency (CRA). This document outlines the amount of tax you owe or the amount of refund you will receive. It is important to review this document carefully to ensure that all of the information is correct. If you find any errors, you should contact the CRA immediately to have them corrected.

Handling Audits

In some cases, the CRA may choose to audit your tax return. This means that they will review your return in detail to ensure that all of the information is accurate. If you are selected for an audit, it is important to cooperate fully with the CRA. This means providing them with all of the information they request and answering any questions they may have. If you have any concerns about the audit process, you should contact a tax professional for assistance.

Amending Your Tax Return

If you discover an error on your tax return after you have filed it, you can amend it by submitting a T1 Adjustment Request form to the CRA. This form allows you to make changes to your return, such as correcting a mistake or claiming a deduction that you missed. It is important to note that you can only amend your return for up to 10 years after the tax year in question.

In conclusion, after filing your taxes, it is important to understand what happens next. You should review your Notice of Assessment carefully, cooperate fully with the CRA if you are audited, and amend your return if necessary. By taking these steps, you can ensure that your tax affairs are in order and avoid any potential issues with the CRA.

Frequently Asked Questions

How can I calculate my federal tax for the year 2023?

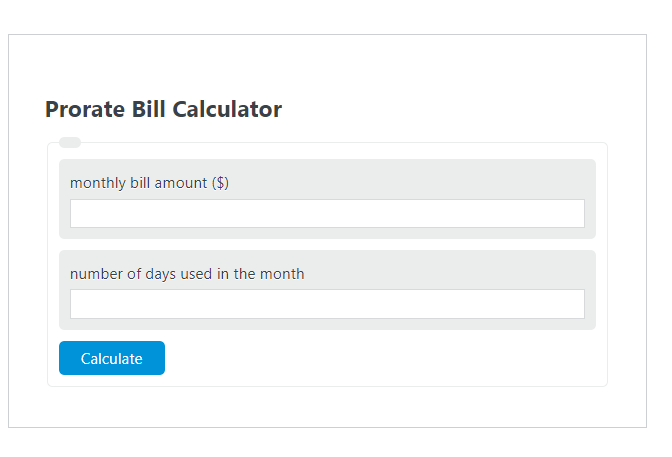

To calculate your federal tax for the year 2023, you can use the IRS Tax Withholding Estimator on their website. This online tool helps employees withhold the correct amount of tax from their wages and also helps self-employed people who have wage income estimate their quarterly tax payments. The Tax Withholding Estimator does not ask for personally identifiable information such as your name, social security number, address or bank account numbers.

What steps should I take to calculate taxes with dependents for 2023?

If you have dependents, you may be eligible for certain tax credits and deductions. The IRS provides a Child Tax Credit and a Credit for Other Dependents. You can also claim deductions for expenses related to child care and education. To calculate your taxes with dependents, you can use the IRS Tax Withholding Estimator and enter the relevant information about your dependents.

Where can I find the IRS tax tables for 2023 to determine my tax bracket?

The IRS tax tables for 2023 will be released closer to the end of the year. You can find them on the IRS website or by consulting with a tax professional. The tax tables will help you determine your tax bracket based on your income level.

How do I accurately use a paycheck tax calculator for 2023 earnings?

To accurately use a paycheck tax calculator for 2023 earnings, you will need to enter your gross pay, pay frequency, filing status, and any deductions or credits that you may be eligible for. The calculator will then estimate your federal tax withholding and provide you with an idea of how much you can expect to receive in your paycheck.

What is the process for estimating my tax payments for 2023?

To estimate your tax payments for 2023, you can use the IRS Tax Withholding Estimator or consult with a tax professional. You will need to enter your expected income for the year, any deductions or credits that you may be eligible for, and your filing status. The estimator will then provide you with an estimate of how much you should pay in taxes each quarter.

How can I use a tax return calculator to estimate my refund for 2023?

To use a tax return Calories Burned Studying Calculator to estimate your refund for 2023, you will need to enter your income, deductions, and credits for the year. The calculator will then estimate your tax liability and subtract it from any tax payments that you have made throughout the year. The resulting amount will be your estimated refund. Keep in mind that this is just an estimate and your actual refund may differ based on a variety of factors.